[[{“value”:”

Huge upward adjustment of total employment coming in February when the BLS incorporates the wave of immigrants into the data.

By Wolf Richter for WOLF STREET.

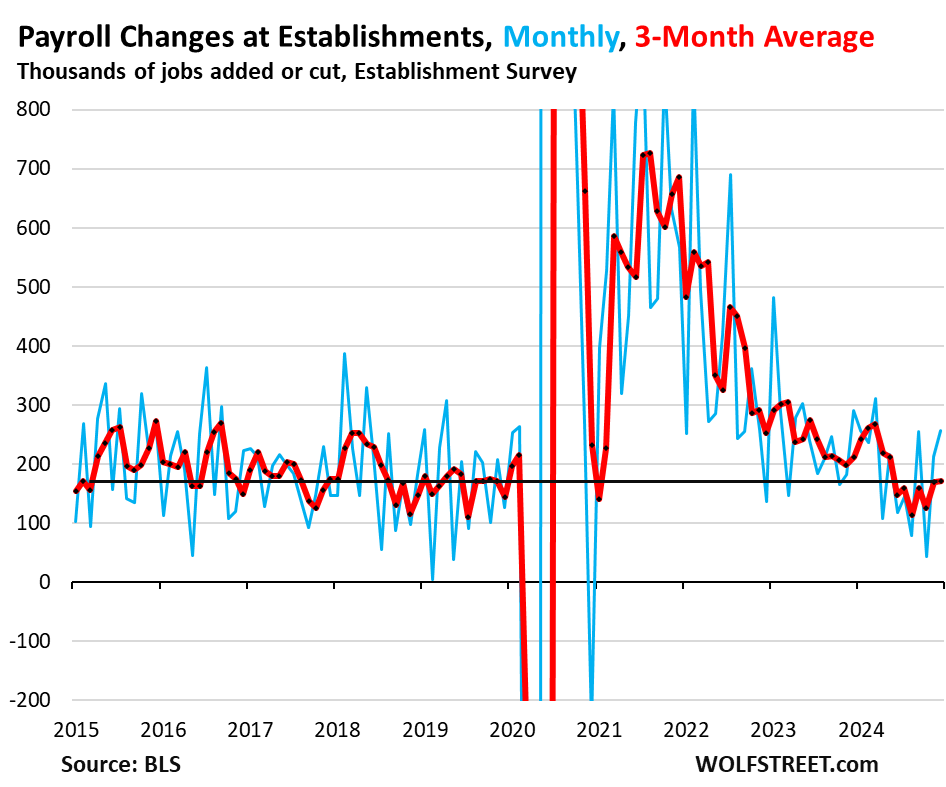

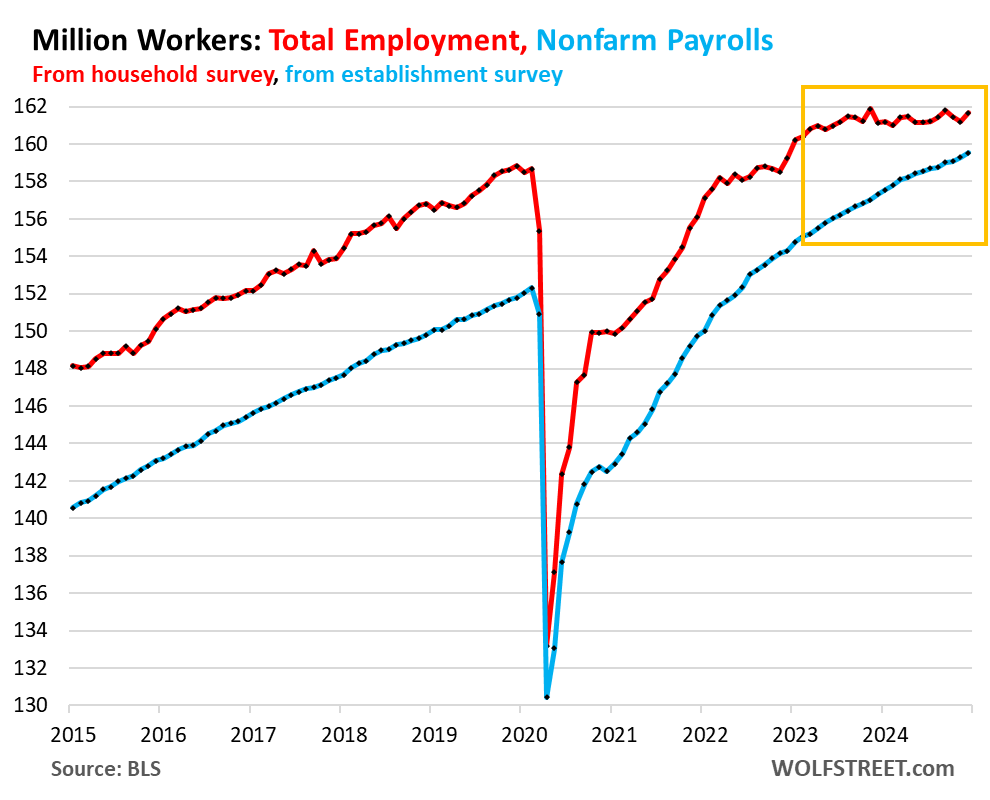

Nonfarm payrolls jumped by 256,000 in December, after having risen by 212,000 in November, to 159.5 million jobs, according to the Bureau of Labor Statistics today (blue in the chart below).

The three-month average rose by 170,000, same as in the prior month, and both had been the biggest increases since May (red). The three-month average irons out the month-to-month squiggles, including the effects of the Boeing strike and the hurricanes that had hammered down October’s job gains but were recaptured in the following months.

Over the past twelve months, employers added 2.23 million jobs, roughly 5% more than the three-year average before the pandemic. These are healthy job gains – in a way, surprisingly strong job gains, given the relatively high interest rates.

Fed rate cuts move further into the distance. The strength of this labor market and the growth of the economy that has been well above the 15-year average – despite the relatively high policy rates by the Fed – have led many to believe, including Fed governor Michelle Bowman yesterday, that the Fed’s policy interest rates are in fact already close to or at “neutral” and don’t need to be cut further to maintain solid economic growth and a healthy labor market.

And upside risks to the inflation outlook and the recent re-acceleration of inflation metrics have further darkened the future of any rate cuts. Powell himself had said at the press conference that “we still have work to do.” Maybe those 100 basis points in cuts is all the economy is going to get, as the Fed is gingerly shifting back into its wait-and-see mode.

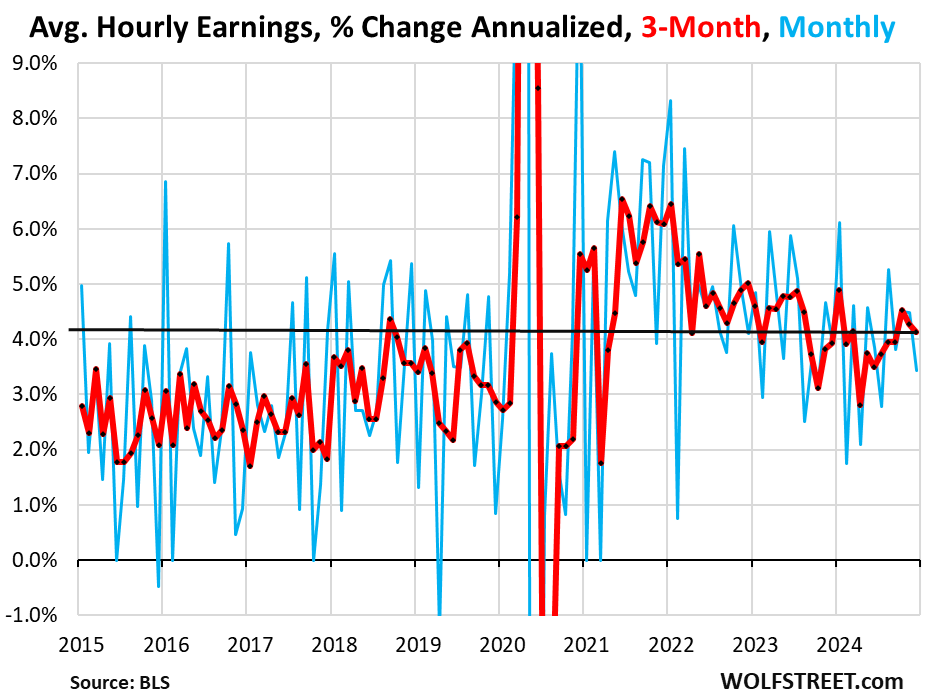

Average hourly earnings rose by 3.4% annualized in December from November, after two months in a row of 4.5% increases (blue line). The three-month average rose by 4.1% annualized in December from November (red).

Year-over-year, average hourly earnings rose by 3.9% in December, similar as in the prior two months. The job gains in those three months were the highest since May, and substantially above even the peaks of the 2017-2019 Good Times period.

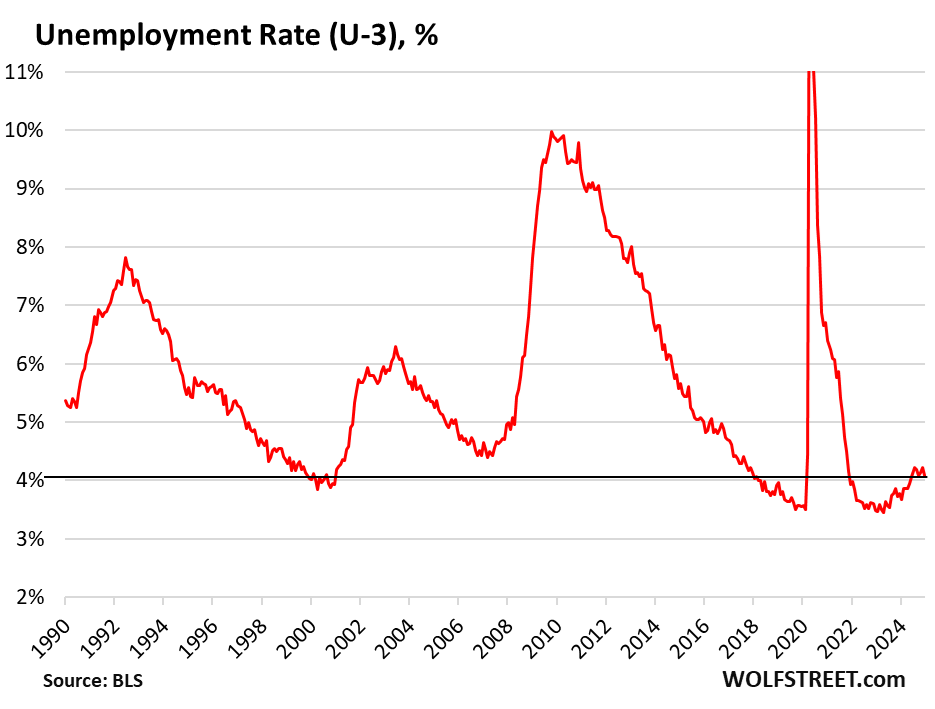

The headline unemployment rate (U-3), based on the survey of households, edged down to 4.1% in December from 4.2% in November. Unrounded, it was the lowest since June. Over the past seven month, the unemployment rate has averaged 4.1%, a historically low unemployment rate.

The unemployment rate = number of unemployed people who’d actively looked for a job over the past four weeks, divided by the labor force (number of working people plus the number of people actively looking for work).

December’s unemployment rate of 4.1% is below the Fed’s median projection for the end of 2024, which it had lowered to 4.2%, and is below the Fed’s median projection for the end of 2025 (4.3%), according to the Fed’s Summary of Economic Projections released at the December meeting.

In late 2023 and in the first half of 2024, the unemployment rate had zigzagged higher from record lows, and the trend was up, and by mid-2024, the Fed started projecting rising employment trends amid weak job creation.

But that up-trend of the unemployment rate broke in the second half. Job creation has stabilized at healthy levels, and the unemployment rate has stabilized around a historically low 4.1%, and the Fed’s projections have stabilized a well.

Employment to be adjusted in February for 8 million new legal and illegal migrants.

The BLS uses the Census Bureau’s population data to extrapolate the employment data from the household survey to the overall population. The household survey generates total employment, the labor force, unemployment, unemployment rate, etc.

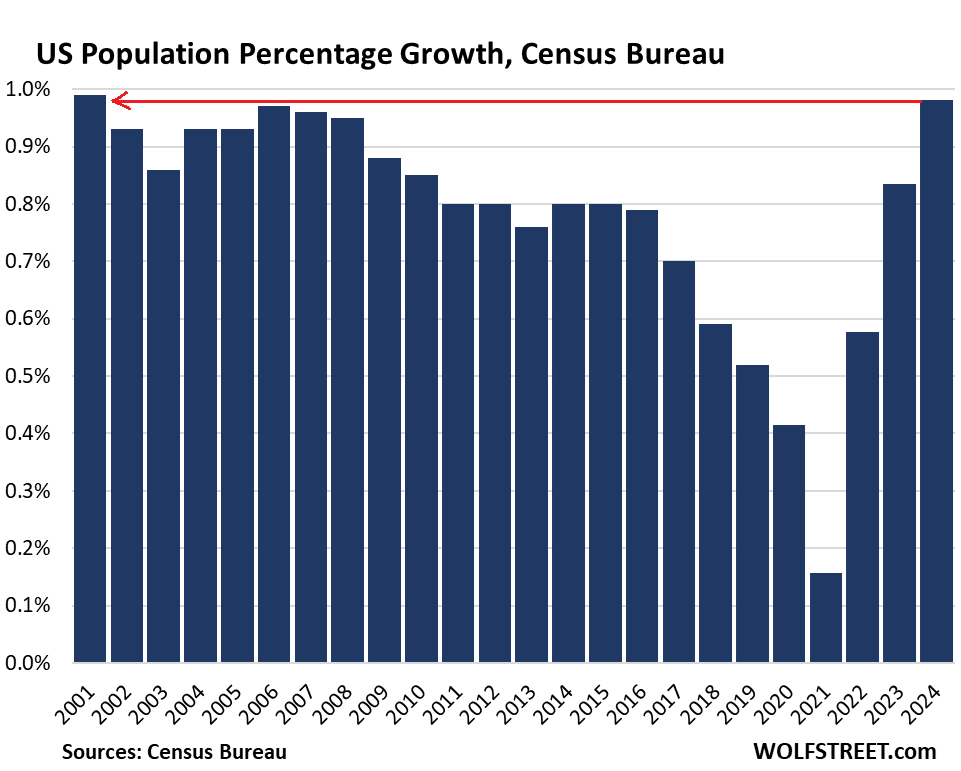

On December 19, the Census Bureau released its annual revision of the US population data, showing that the US population soared by 8.01 million people in the three years from July 2021 through July 2024, mostly from net-immigration, both legal and illegal. Many of these immigrants are already working, or are looking for work.

This population surge is not included in today’s employment data, but will be included in the employment data to be released in February, the BLS said today.

In percentage terms, the US population increased by nearly 1% in the 12 months through July 2024, the biggest increase in 23 years (we discussed this in detail here).

We expect large up-adjustments of employment, labor force, and related metrics. We expect to see a spike of the employment level for January that recaptures the entire adjustment for the three-year period (the BLS doesn’t revise the prior years with the population data, it does it all in one fell-swoop for the month of January).

So next month, the up-adjustment of total employment from the January household survey, plus the inclusion of the previously announced downward revisions of nonfarm payrolls from the establishment survey should re-establish the historic relationship between the employment level of the household survey and nonfarm payrolls from the establishment survey.

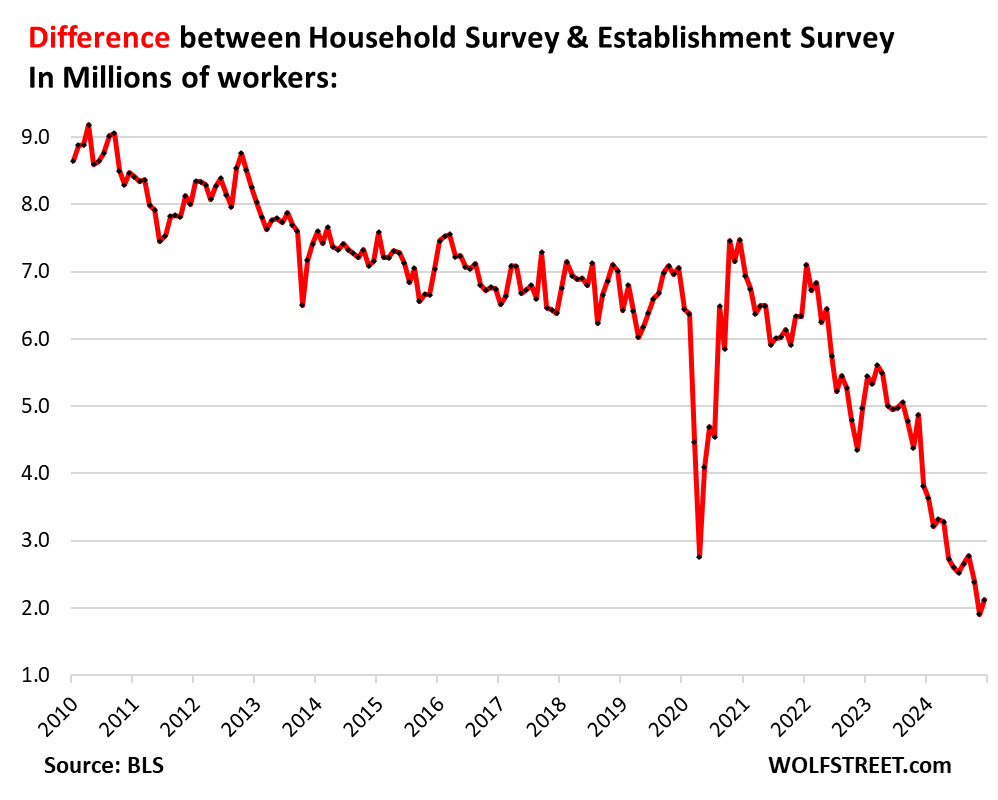

The household survey includes workers who are excluded from nonfarm payrolls reported by establishments, such as self-employed workers whose businesses are not incorporated, farm workers, and private household workers. So, total employment as depicted by the household survey is typically 6-8 million workers higher than nonfarm payrolls. But that difference has shrunk over the past two years and was just 2.1 million workers in December.

Total employment, lacking the new migrants who are working, has been relatively flat since mid-2023, and grew only slowly in the prior year (red), while nonfarm payrolls have continued to rise at a solid pace (blue).

We expect the population adjustment in February to create a spike in the red line for January; and we expect the inclusion of the benchmark revisions to lower the blue line somewhat; and the combination should re-establish the typical spread between the two:

This is how the spread between the employment level in the household data and nonfarm payrolls has shrunk from 6-7 million in prior years to 2.1 million in December. We should see a very sharp reversal next month back toward or over the 5-million line:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post This Strength of the Labor Market & Economy, amid Accelerating Inflation, Puts the Fed Back into Wait-and-See Mode appeared first on Energy News Beat.

“}]]