[[{“value”:”

“Such temporary rate pressures can be price signals” that help markets redistribute liquidity to where it’s needed most: Fed’s Logan

By Wolf Richter for WOLF STREET.

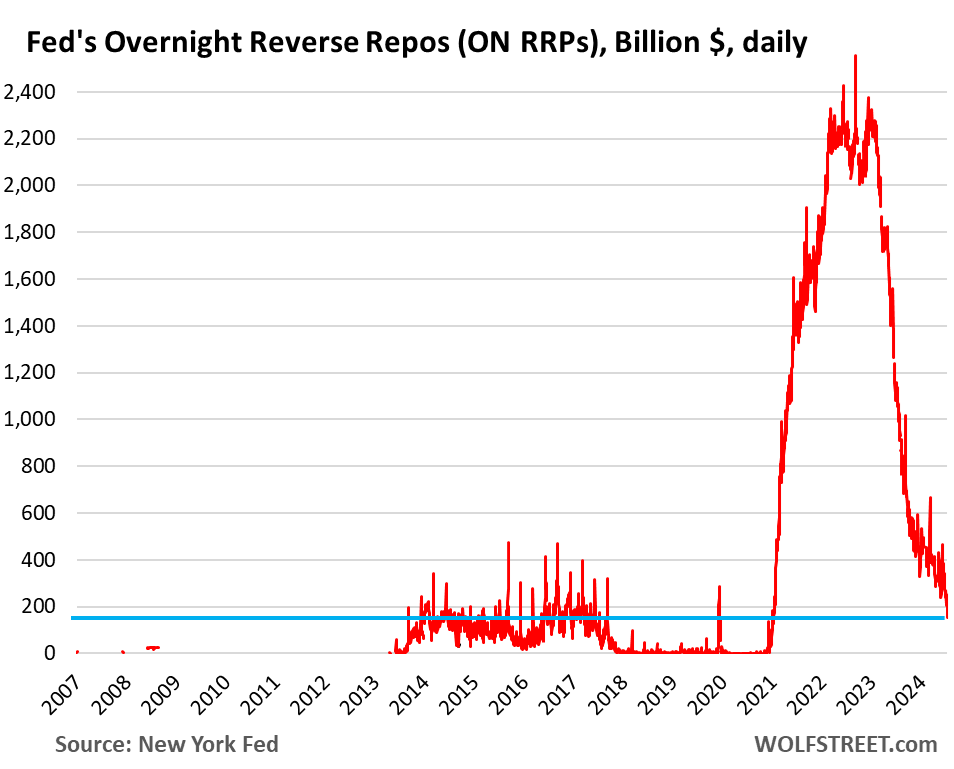

ON RRPs – Overnight Reverse Repurchase agreements – fell to $155 billion today, the lowest since April 2021, down from the $2.3-trillion range prevailing in May 2022 through June 2023, and down by $2.4 trillion from the peak at the end of December 2022. ON RRPs are well on their way to zero or near-zero, where they were in normal times.

ON RRP balances represent cash that money market funds mostly put on deposit at the Fed to earn the interest that the Fed pays on ON RRPs as part of its policy rates, currently 4.8% since the rate cut on September 18.

They’re excess liquidity the Fed created during QE that financial markets don’t know what else to do with. The Fed has now drained about $2 trillion in liquidity from the markets via its QT, and essentially all of the drainage has come out of ON RRPs, instead of reserve balances.

The spikes in the chart occurred at quarter-end and at year-end for window-dressing purposes.

Money market funds have many other options, including buying Treasury bills and lending to the repo market. They will shift funds to where they can earn a little more and still satisfy their liquidity and regulatory needs.

Money market funds can currently earn 4.80% with ON RRPs, and they can earn a few basis points more by engaging in overnight repos in the repo market. There are $6.5 trillion in money market funds, of which $155 billion are now on deposit at the Fed. They mostly place their funds where they can earn more.

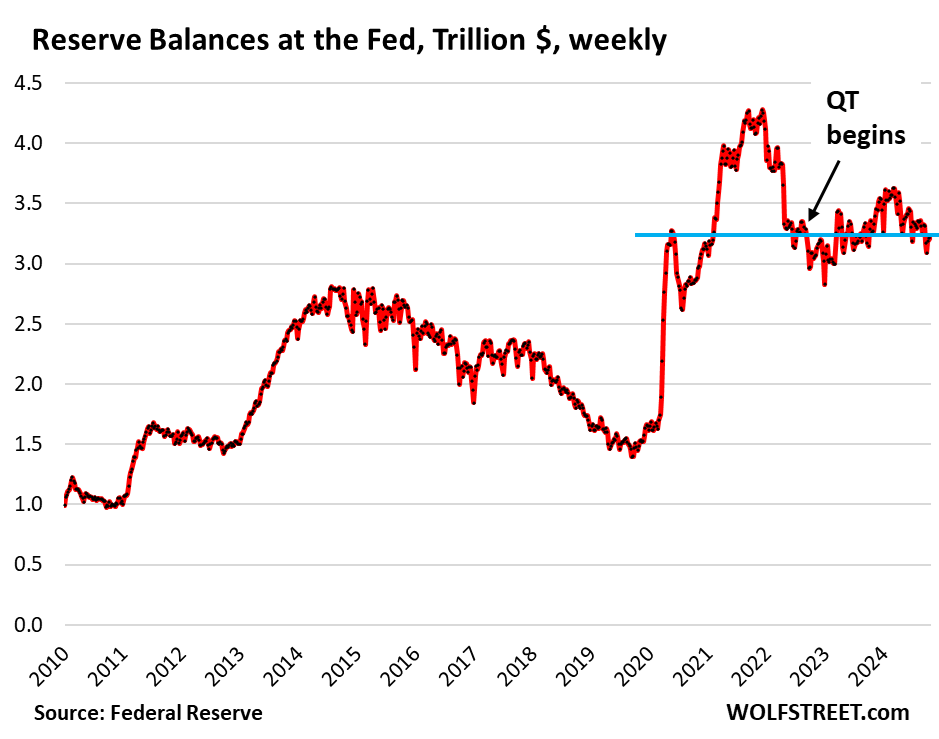

Reserve balances are the banking equivalent to ON RRPs. They represent cash that banks put on deposit at the Fed.

The purpose of QT is to drain liquidity out of the financial system by bringing ON RRPs down to near-zero and by bringing reserves down to merely “ample” from “abundant.”

But reserves have essentially not dropped since QT began in mid-2022. They did drop before QT started. The dropped from the peak at the end of 2021 through mid-2022 as funds shifted from banks to money market funds, and money market funds put their excess cash on deposit at the Fed, which caused ON RRPs to spike even as reserves plunged before QT started.

The fact that reserves are still at $3.24 trillion, essentially unchanged from July 2022 when QT started, shows that there is still aways to go with QT.

“Temporary rate pressures can be price signals” that help markets redistribute liquidity: Fed’s Logan.

Wall Street hates QT, and so earlier this year, there was this big to-do in the financial media how the Fed would be “forced” to end QT when ON RRPs drop to $700 billion or whatever, because it would drain so much liquidity out of the system that something would blow up when ON RRPs drop below $700 billion. And now they’re getting closer to zero or near-zero, and nothing has blown up, and reserve balances are still plump and ready for draining.

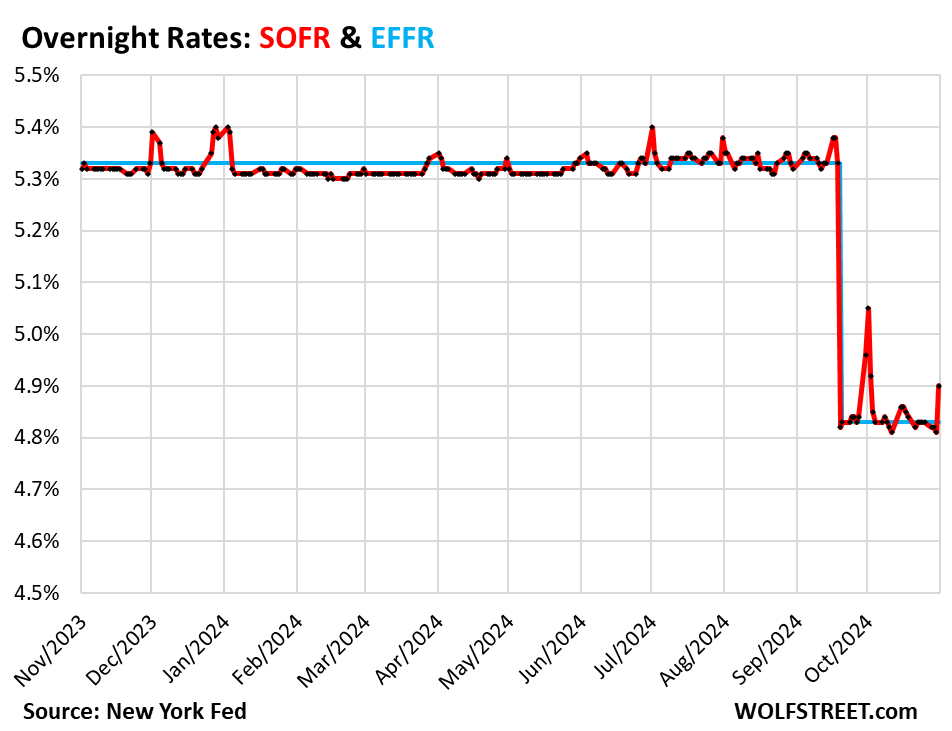

But spreads in the overnight funding markets have started to move, especially at month-end and at quarter end. The New York Fed maintains several indices of these overnight funding markets, and we’ll look at the recent details of three of them. Note the daily volume, from $100 billion (EFFR) to $2.2 trillion (SOFR):

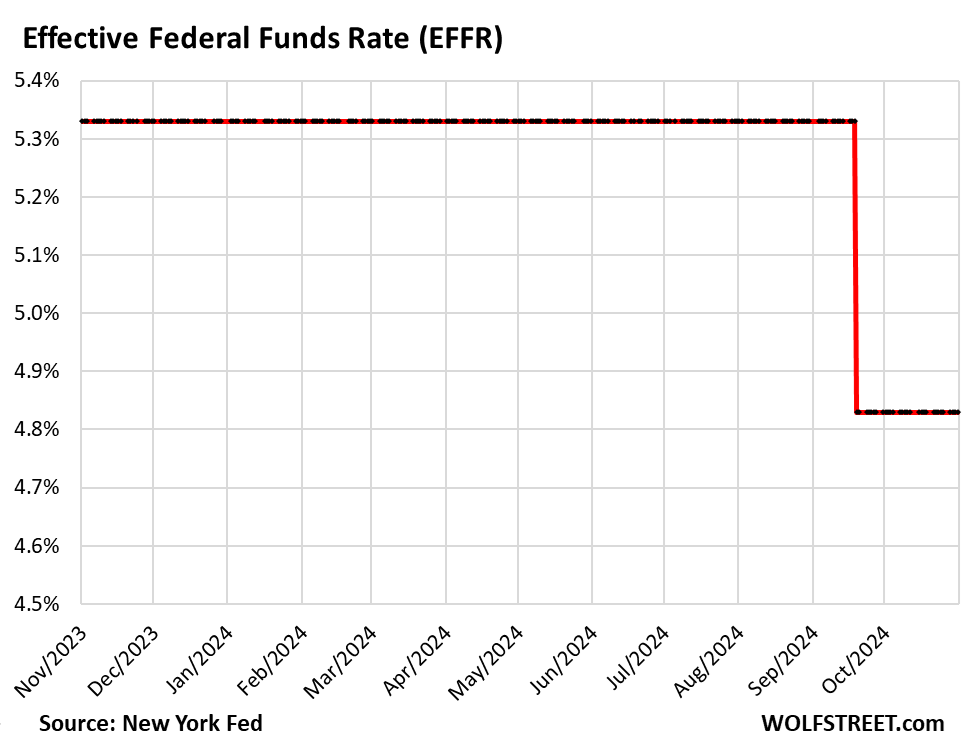

- Effective Federal Funds Rate (EFFR) tracks about $100 billion in daily volume of unsecured overnight lending between banks.

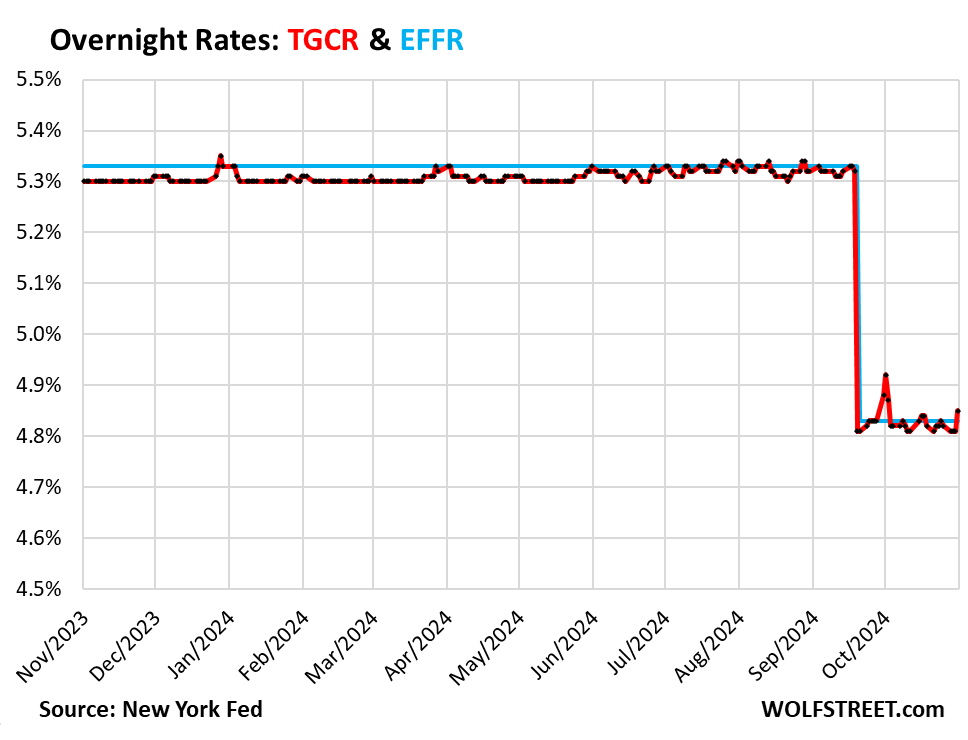

- Tri-Party General Collateral Rate (TGCR) tracks about $750 billion in daily volume of repos secured by Treasury securities.

- Secured Overnight Financing Rate (SOFR) tracks about $2.2 trillion in daily volume of a broader set of Treasury repos than TGCR.

The EFFR is held in the middle of the Fed’s target range by the New York Fed’s “open market operations.” Before the rate cut in September, the EFFR was 5.33%. Since the 50-basis-point cut, it has been 4.83%, without any kind of drama and only minuscule intraday variations if any:

The TGCR has experienced some yield mini-spikes, particularly at the end of last quarter when it rose by 11 basis points to 4.92% from 4.81% a few days earlier, building a positive spread of 9 basis points to the EFFR, when normally the TGCR (secured) is below the EFFR (unsecured). It then quickly fell back.

At the end of October, it rose by 4 basis points to 4.85% from 4.81%, building a positive spread to the EFFR of 2 basis points.

The SOFR experienced more movement. At the end of the quarter, it jumped 22 basis points to 5.05%, from 4.83% a few days earlier, widening the spread to the EFFR by 22 basis points. SOFR then quickly settled back down. At the end of October, it rose to 4.90% from 4.81% the day before, widening the positive spread to EFFR by 7 basis points.

Dallas Fed President Lorie Logan has spoken two weeks ago on precisely this issue of temporary increases of the overnight rates. She is a leading voice on the technicalities of the Fed’s balance sheet, QT, and liquidity issues due to her prior gig as executive VP of the New York Fed, managing the Fed’s securities portfolio and open market operations.

She said in her speech on normalizing the size and composition of the Fed’s balance sheet as QT moves forward:

“Such temporary rate pressures can be price signals that help market participants redistribute liquidity to the places where it’s needed most.

“And from a policy perspective, I think it’s important to tolerate normal, modest, temporary pressures of this type so we can get to an efficient balance sheet size.”

These sporadic mini-spikes of overnight rates in the repo market indicate that the financial system isn’t totally drowning in excess liquidity anymore, that there is still lots of excess liquidity but that markets once again are starting to fulfill their role in using rates to direct liquidity from where it’s in excess to where it’s needed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post Fed’s ON RRPs Plunge to $155 Billion as QT Drains Liquidity, Nothing Blown Up Yet. SOFR & TGCR Spreads Begin to Move appeared first on Energy News Beat.

“}]]